Banks and Credit Unions, Billing, Collections and Payments, Industry News, Technology and Mobile

The Future Of Payment Processing: Exploring the Benefits of Mobile Wallets

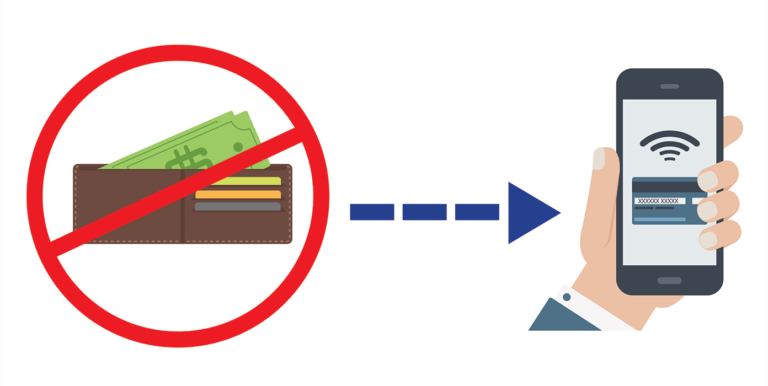

How Digital Wallets are Changing the Way We Handle Payment Processing?

The Washington Post reported that eight in ten people carried less than $50 in their wallets. In the months since then, there’s a good chance that statistic has increased to nine out of ten. Most people carry wallets to keep their credit cards, driver’s licenses and children’s pictures, but very few put money inside them anymore. The move towards a cashless society is closer than ever. Mobile wallets have arrived, but will they ever replace a traditional wallet?

Smart bank cards, cell phone-based credit card processing, and other technologies have almost completely replaced cash, and there are significant benefits for consumers and financial institutions.

What are the Benefits of Mobile Wallets?

Mobile payments offer numerous benefits that enhance convenience and security in financial transactions. Here are some key advantages of using mobile wallets:

- Simplified Payments: Digital wallets enable quick and hassle-free transactions, allowing users to make payments with just a few taps on their smartphones.

- Instant Money Transfer: Send and receive money in seconds, making it convenient for splitting bills or transferring funds to family and friends.

- International Money Transfers: Some wallets facilitate easy and secure international money transfers, eliminating the need for traditional methods and associated fees.

- Efficient Expense Tracking: Mobile payments provide the ability to track expenses, helping users monitor their spending habits and gain insights into their financial behavior.

- Enhanced Security: Mobile wallets employ robust security measures such as encryption and biometric authentication, ensuring secure transactions and protecting against fraud.

- Loyalty Rewards: Many mobile wallets offer loyalty programs and bonus awards, allowing users to earn rewards and enjoy exclusive discounts with participating merchants.

- Streamlined Account Management: e-Wallets enable users to conveniently manage their credit cards, track transactions, and view account balances, all in one place.

The growth of mobile payments has seen an increase of 37% every year. The convenience of mobile payments is not lost on consumers. People are starting to use mobile payments in growing numbers.

Businesses of All Size Have Equal Access to the Internet

There was a time when small businesses could only accept cash or checks. There have been many recent advances in mobile payments from Square, TD, Intuit and other companies. They have made it possible for business owners to affordably accept debit and credit card payments on mobile devices. These mobile payment options are a big leap forward. However, there hasn’t been an affordable and easily accessible option for small businesses looking to use NFC payment technology. Mobile payment solutions like Google Pay and Apple Pay may be the catalyst that changes all of that. It’s only a matter of time before small businesses catch up.

How Do Digital Wallets Benefit Banks?

Mobile or digital wallets provide several benefits to banks, enhancing their services and the customer experience in the following ways:

- Increased Customer Engagement: Offering mobile or digital wallets allows banks to engage with tech-savvy customers who prefer convenient and secure digital payment options.

- Enhanced Customer Loyalty: Banks can strengthen customer loyalty and increase retention rates by providing a seamless and user-friendly mobile wallet experience.

- Cost Savings: Mobile or digital wallets reduce the need for physical infrastructure and manual transaction processing, resulting in cost savings for banks.

- Data Insights: Mobile payments generate valuable data on customer spending patterns, enabling banks to gain insights into consumer behavior and develop targeted marketing strategies.

- Cross-Selling Opportunities: Integrating additional financial services within digital wallets opens up cross-selling opportunities for banks, allowing them to promote products like loans, insurance, and investment options.

- Fraud Reduction: Mobile or digital wallets incorporate advanced security features such as encryption and biometric authentication, reducing the risk of fraud and enhancing overall security.

- Competitive Advantage: Offering mobile or digital wallets helps banks stay competitive in the evolving financial landscape, attracting tech-forward customers and meeting their expectations for digital banking solutions.

By leveraging mobile or digital wallets, banks can drive customer engagement, improve operational efficiency, and gain a competitive edge in the digital banking space.

Learn more about eStreamOne, FSSI’s electronic bill presentment solution and see how we can help support your mobile payment strategies.