Print and Mail Outsourcing Services for Credit Unions

FSSI’s full-service credit union statement processing and mailing solutions can help your credit union increase the effectiveness and ROI of monthly member documents while improving member retention.

Whether you serve a local, regional, or national member base, FSSI can tailor a print and mail outsourcing solution to fit your credit union’s needs. Through attention-getting color, eye-catching graphics, and targeted messaging, we create inviting, easy-to-read printed or digital content that builds member trust by speaking to their unique informational needs and interests.

Our full-service statement printing and mailing solutions include:

- Statement processing

- eStatements and electronic bill presentment

- Variable data printing and statement marketing tools

- Integrations with major data processors

- Marketing letters and direct mail

- In-house design and development team

- 24/7 reporting and workflow management

About FSSI

For 45 years, FSSI has supported credit unions with reliable print and mail outsourcing services, focusing on secure, member-centric communications. We specialize in statement processing, eDelivery, personalized marketing mail, and secure document archival, tailored to credit unions. As a secure print and mail company with secure facilities and a strong commitment to data security (SSAE-18 Type II audited), we empower credit unions to build stronger member connections.

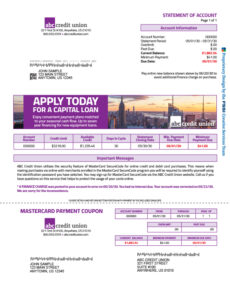

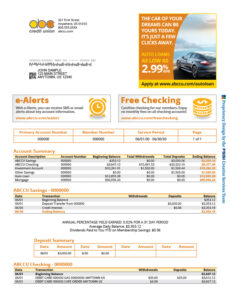

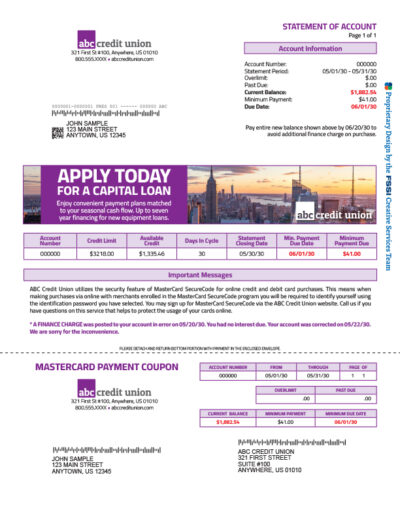

Statement Sample PDFs

Take a deeper look at our statement processing and mailing solutions.

What Types of Member Documents Are Produced at FSSI?

Our document mailing solutions were designed with the needs of credit unions and their members in mind. Solutions include the design, production and delivery of both transactional and marketing-related member documents, including:

- Deposit, draft, savings or combined bank statements

- Compliance letters and notices

- Credit card statements

- Auto loan, line of credit and mortgage statements

- Annual tax forms

- Privacy mailings

- Loan offer letters

- Welcome letters or packages

- Special fulfillment packages

- Direct mail with fully automated digital integration

- Loan documentation mailings

Navigator Credit Union Case Study

Navigator Credit Union was looking for strategic solutions to redesign statements while ensuring the compliant production and delivery of monthly and quarterly statements, with space that allowed for marketing messages and annual disclosures. The credit union partnered with FSSI to evaluate their member statement strategy and recommend ways to enhance operational efficiency, improve member experience and ease mail reconciliation efforts. Learn more about how Navigator Credit Union improved its member experience.

Statement Outsourcing for Credit Unions

With 45 years of experience serving credit unions, FSSI offers a comprehensive suite of print and mail services. From transactional to marketing communications, our services include design, formatting, data processing, production and delivery. Transform ordinary monthly statements into powerful promotional tools with our integrated marketing solutions.

Full-Service Outsourced Print Solutions for Credit Unions

FSSI combines proven mail-and-marketing know-how with customized application programming to deliver cost-effective document mailing services, stimulate your financial institution’s growth, strengthen relationships, and improve member engagement and retention. Examples include:

Document Design and Production

- Document redesign and layout composition

- Full-color digital inkjet printing

- Inline check images with statements

- Online links to check image repositories

Mail Handling and Inserting

- Optimized postage and envelope costs

- Co-mingling and inline postal sorting

- Selective insertions based on data-driven variables

- Return Mail solutions to help manage undeliverable mail

Value-Added Features and Services

- Personalized, targeted messages and imagery

- eNotifications (email and text messages)

- Personalized URLS (PURLs)

- In-line envelope printing

- Multichannel direct mail marketing campaigns

- 24/7 online workflow and job approval dashboard

Integration with Existing Credit Union Data Providers

FSSI’s comprehensive and advanced solutions for credit unions seamlessly blend with all leading credit union data providers and platforms, including Jack Henry & Associates. These integrations help streamline and optimize the process of delivering critical communications and ensuring the efficient and accurate dissemination of information.

eStatement Services

Are you looking to increase eStatement adoption? When customers opt in for eStatements, your financial institution saves money on printing and mailing paper statements.

FSSI’s eStatement processing services help you improve the layout, design and readability of your eStatements and electronic documents. Drive more customers with electronic delivery and improve the customer experience for your existing eStatement customers.

Our robust electronic statement services offer a variety of enhancements and add-ons to your eStatement program. Some of our enhancements include:

- API, single sign-on and fully-hosted online portals

- Electronic notifications and payment integrations

- Client-facing online reporting dashboard

- Dedicated account representative and project manager

- Savvy preference management for SMS, text and email notifications

Utilize custom electronic presentment services, including eStatements, SMS text messages, and mobile payment integration. We have in-house graphic designers and developers to help optimize and get your communications to the market fast. You can also leverage the power of personalization on both transactional and marketing-related documents.

Regulatory Compliant Data Security and Privacy Practices

Government regulations from the FDIC, the CFPB, and other regulatory bodies governing local and federal credit unions are always changing. We maintain and constantly update our technological and physical security and data privacy practices. Protecting personally identifiable information and sensitive member data is critical to us and the financial institutions we serve.

Our core values include a strong focus on data security, privacy, business continuity, and disaster recovery. FSSI undergoes annual SOC 2 audits and maintains HIPAA compliance in our facilities, with rigorous security practices that exceed industry standards, including:

- Building security

- User/server-level security

- Secure data standards

- Secure data archival options

- Document security

- Employee training

Direct Mail Marketing Services for Credit Unions

Direct mail marketing is still one of the best-performing marketing channels for credit unions – it is something that can help credit unions reach their prospects on a more personal level. As consumers, we are so inundated with emails and display ads. Direct mail fills the gap between the digital and physical advertising channels.

We have extensive experience in handling sensitive financial information. We apply that same data-handling expertise to your credit union direct mail campaigns. Whether you send out postcards, letters, or any other type of credit union marketing mailer, you can expect the same data security and privacy standards.

Direct Mail Services for Credit Unions Include:

- Postcards

- Letters

- Variable data printing

- Mailing lists

- Online re-targeting and digital marketing automation

- Online dashboard for campaign tracking and analytics

We offer a data-driven, end-to-end multichannel direct marketing solution. Your credit union’s direct mail campaign works in tandem with robust digital marketing for stellar results. It includes an automated process that is 100% done for you, with the right promotional activities in place to extend the reach of your credit union marketing efforts, including full attribution in an online dashboard for visibility and tracking.

If you are looking to learn more about our advanced direct mail marketing campaigns, visit our Direct Mail and Marketing Services Division, Splash.

No-Obligation Statement Processing and Mailing Consultation

Our secure processes and technology enable us to provide 100% data-to-document integrity and output accuracy at every step. We can even help you reach specific members with impactful member documents that generate action and ROI. Let us help your credit union securely process:

- Member statements

- Marketing communications

- Tax forms

- eStatements

- Monthly newsletters

- Multichannel direct mail campaigns

- And more!

Contact us online or call us at (714) 436-3300 today for a no-obligation credit union print and mail outsourcing consultation, to schedule a product demo or a review of your existing member documents.