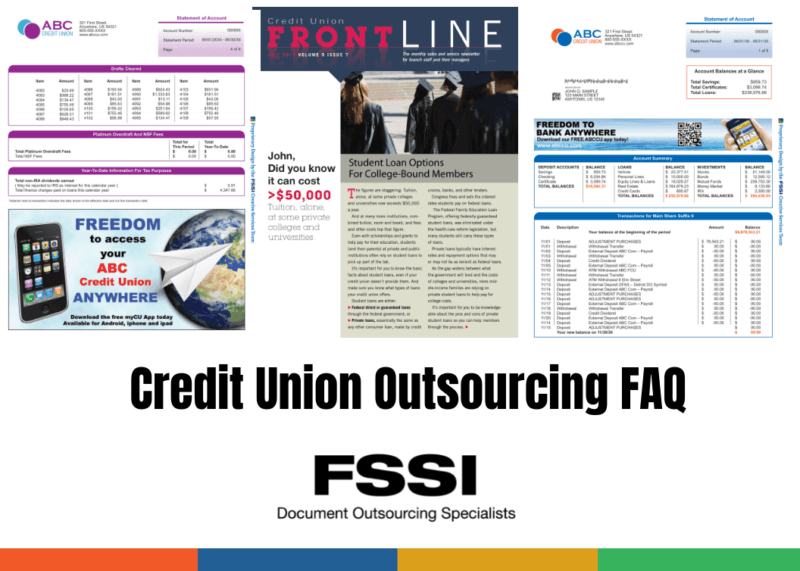

Credit Union Outsourcing FAQ

Commonly Asked Questions About Outsourcing Print and Mail for Credit Unions

Why should credit unions outsource their print, mail and eStatement processing?

Credit unions have outsourced the production of printed and electronic member documents for decades. Many financial institutions outsource because it can significantly reduce postage, production and delivery costs, including purchasing and managing paper stock. Other credit unions outsource because of the provider’s superior data security or handling capabilities or regulatory-compliant document-production practices.

Credit unions have chosen FSSI to leverage their investment in electronic statement presentment and payment technologies, including mobile delivery. Mobile optimization enables credit unions to meet members’ multi-channel preferences by leveraging PDF and HTML documents and responsive web design formatting.

What are the main benefits of outsourcing for credit unions?

Credit unions usually select FSSI for three reasons: extensive knowledge of their industry and member-communication challenges, our investment in network, data-security, cutting-edge print and mail technologies, and the quality and responsiveness of our credit union service and support teams, including client services, project management, development and onboarding processes.

How much credit union experience does FSSI have?

FSSI has over 40 years of experience serving credit unions of all sizes throughout the United States. One of our very first clients was a credit union. We’ve worked with both local and federal credit unions.

How quick is the onboarding and conversion process for credit unions?

The short answer is “it depends.” That’s because every conversion is different and tied directly to the crucial preparation that must be completed before converting. Driven by formatting requirements, scheduling, overall complexity, and other considerations, the process can take several days or several months. However, using time-proven methodologies and helpful client checklists, FSSI’s credit union data experts will support you in ensuring the smoothest, most efficient conversion possible.

Does FSSI integrate with existing credit union data providers?

FSSI’s experience includes small – and large-scale integration with all leading credit union data providers and platforms, including Symitar® from Jack Henry and Associates. If you have a specific question related to data handling, contact one of our credit union specialists today.

What compliance management measures are in place to ensure that statement processing meets changing government regulations?

FSSI regularly assesses its production processes and workflow to ensure compliance with the latest regulations. For years, we’ve held the SSAE-18 Type II (SOC 2) security certification – in addition to being HIPAA compliant – and voluntarily undergo the annual audit required to maintain this coveted designation. In conjunction with a security and quality control process audit, auditors also conduct rigorous network vulnerability and social media and risk assessment reviews. Learn more about the audit here. Or click to review our security practices and policies and secure printing and mailing equipment.

Does FSSI mostly work with large credit unions?

Not at all. We have several large, recognizable credit unions as clients; however, we also serve small and mid-size institutions with varying levels of outsourcing experience.

What types of integrated marketing and customer engagement capabilities does FSSI have?

Our flagship credit union marketing and member engagement platform equips credit unions with the tools to economically develop data-driven, multichannel campaigns based on document design and communications best practices. Technologies that comprise the solution include:

- Full-color inkjet technology that supports MICR ink printing, inline dynamic perforating and integrated camera technology to verify the integrity of each unique piece.

- Statement messaging provides real-time design control over your statements’ on-page message-text and graphics, with a portal that lets credit unions create, approve, upload and selectively place full-color digital graphics and promotional/educational messaging. Elements may be tied directly to variable account data to dynamically create personalized member communications.

- Cross-Media Communications to develop and deploy creative multichannel member campaigns that feature unique URLs, Mobile (QR) codes, dynamic landing pages, and targeted opt-in emails.

Does FSSI’s credit union outsourcing solution include year-end tax forms?

Yes, a popular service among FSSI’s credit union clients is tax forms processing. Our methods, many of which are unique in the industry, include time-saving features and options that credit unions find attractive. This includes a proprietary Tax Form Tool with Editable PDFs.

Do you share credit union or financial service industry information via social media?

Yes, FSSI is very active on social media, posting regularly to Twitter, LinkedIn, and other platforms. We follow (and are followed by) credit unions across the nation. We also interact with numerous industry organizations and media, such as CUNA, The Credit Union Journal, Credit Union Magazine, and others. Share in our ongoing dialog and information exchange, including the latest tips, trends, and technologies for credit unions. Follow us on Twitter at @FSSI_CA and on LinkedIn.

New to outsourcing or looking for a new provider? Take advantage of FSSI’s pioneering leadership and 40+ years of credit union experience. Call 714-436-3300 today for a no-obligation document production or data conversion consultation, or contact a credit union specialist with your specific questions.