Print and Mail Services for the Mortgage Industry

FSSI’s print and mail fulfillment services help any company in the mortgage industry feel confident right from the start. That’s because we offer the integrated communication solutions needed to keep borrowers and regulators happy, including personalized support, in-house programmers and 24/7 compliance and production reporting that’s only available at FSSI.

Outsourced Print and Mail Fulfillment Services for Mortgage Lenders

Transactional mortgage documents, including loan statements, letters and notices, provide a unique and powerful way to share and connect with customers – but only if you have the tools to target and control your content.

At FSSI, our primary focus is on providing clients with a regulatory-compliant loan document process. Automation plays a vital role in improving our business efficiency. We’ve integrated automated print and mortgage document management procedures to support our clients’ needs for a secure, timely and compliant print and mail solution for loan disclosures and other borrower documents.

Print and Mail Solutions for the Mortgage Industry Include:

- Transactional statements

- Regulatory loan document mailings

- Electronic document delivery

- Direct mail marketing

- Letter template management

- Workflow and mailpiece tracking

About FSSI

With 45 years of experience, FSSI is a leader in print and mail outsourcing for the mortgage industry, ensuring secure and compliant borrower communications. We manage the production and delivery of statements, regulatory notices, and personalized marketing materials crucial for mortgage lenders and servicers.

Our secure operations (SSAE-18 Type II audited), advanced technology and focus on accuracy help mortgage companies engage borrowers throughout the loan lifecycle.

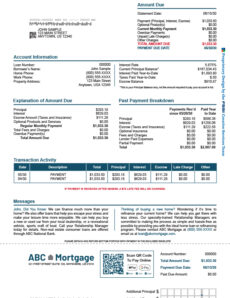

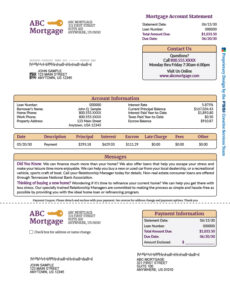

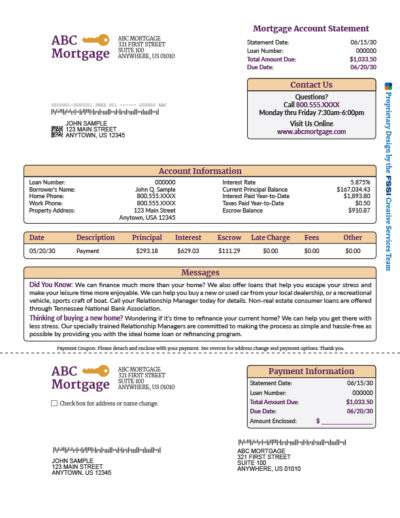

Mortgage Document Sample PDFs

Take a deeper look at our statement printing and mail outsourcing services.

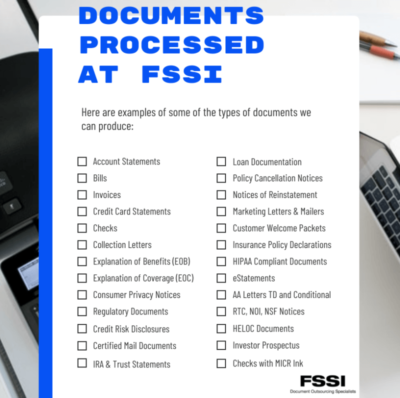

Types of Mortgage Documents We Process

We understand the vital role that diverse documents play in the mortgage industry. Our print and mail services cover an array of document types, each serving a unique purpose in your communication strategy. From welcoming your clients and addressing credit matters to navigating regulatory requirements and boosting marketing efforts, our print and mail solutions cater to the strict needs of mortgage lenders.

Whether you require loan modifications, privacy notices, state-mandated documents, or HELOC documentation, we’ve got you covered.

- Welcome, declination and credit collection letters

- Past due, privacy and compliance notices

- Direct mail marketing, postcards and cross-selling materials

- Loan modifications and refinancing proposals

- Escrow documents

- Notice of the right to rescind

- State and local government-mandated documents

- Direct mail postcards and mailers

- HELOC documentation

- Credit and loan statements and disclosure notices

- DDA statements

Scalable Lender Document Management and Mailing Solutions

Effective communication through transactional documents like loan statements and notices is paramount. FSSI’s mortgage printing solutions unlock the full potential of these touchpoints, enabling you to forge deeper customer connections and drive engagement.

We specialize in streamlining mortgage document processes by leveraging cutting-edge automation. Our seamless outsourcing services ensure secure document printing and timely mortgage document delivery of critical communications, including home loan disclosures.

Read more about the security and privacy infrastructure at FSSI, and see why our clients have trusted us to process and distribute secure financial documents for nearly 45 years.

Value-Added Mortgage Document Management Services

Leverage our team of seasoned mortgage industry experts to tailor a robust, fully-integrated print and mail solution that suits your unique needs. Our comprehensive suite of online tools empowers your mortgage company to operate with unparalleled efficiency:

- Electronic Presentment: Enhance borrower satisfaction and drive eAdoption with our secure document printing and electronic delivery solution. Streamline communication, reduce costs, and simplify dispute resolution.

- Letter Management: Optimize your portfolio communication and collections with our mortgage mail services. Our online print-mail fulfillment solution offers real-time template management and effortless content revision, ensuring seamless communication.

- Secure Compliance: Maintain regulatory compliance with our online job monitoring tool, providing full visibility into the production and delivery of each loan document.

- Convenient Online Bill Pay: Simplify payments for borrowers with our secure online payment platform. Enable seamless credit card, debit card, or ACH transactions for a hassle-free borrower experience.

Experience the FSSI difference and transform your mortgage communication strategy. Contact us today to explore our comprehensive suite of outsourced print and mail solutions.

Mortgage Document Redesign Services

With FSSI’s document redesign and personalization services, your mortgage company can explore a world of possibilities in document design, composition, and messaging. Maximize the potential of your communications by:

Guiding Payment Remittance

Enhance customer experience and reduce late payments while ensuring smooth cash flow. Leverage design elements like eye-catching graphics or icons to highlight payment options, make interest rates and balances easily readable and boldly emphasize key information such as due dates and amounts.

Boosting Cross-Selling

Discover cost-effective ways to support marketing efforts and cross-sell other loan products. Utilize our unique document message management tool to add data-driven graphics and text, creating highly targeted, personalized on-page educational or promotional messages that captivate your audience. Learn more about transpromotional marketing.

Data Security and Privacy Practices

Staying current with ever-changing government regulations poses a constant challenge. FSSI excels in this environment, embracing the challenge and prioritizing data security. In this era of evolving regulations, we uphold rigorous standards to protect personally identifiable information and sensitive financial data.

Our core values include a strong focus on data security, privacy, business continuity, and disaster recovery. FSSI undergoes annual SOC 2 audits and maintains HIPAA compliance in our facilities, with rigorous security practices that exceed industry standards, including:

Our security practices are second to none, and include:

- Building security

- User/server-level security

- Secure data standards

- Secure data archival options

- Document security

- Employee training

Direct Mail Marketing Services for Mortgage Lenders

With over four decades of experience handling sensitive financial information, we extend our expertise to empower the mortgage lending industry with cutting-edge direct mail solutions. Whether you’re sending postcards, letters, or any other form of direct mailer, rest assured that we uphold the highest data security and privacy standards.

Direct Mail: Your Sales Team’s Mighty Ally

For mortgage lenders, direct mail emerges as a practical choice for reaching new customers and engaging existing ones. Think of it as an extension of your sales team, working tirelessly to forge connections and foster brand loyalty. Despite the digital age, direct mail marketing remains a potent and preferred choice for numerous organizations.

Mortgage Direct Mail Services Offered

- Postcards

- Letters

- Variable data printing

- Targeted mailing lists

- Digital marketing automation and online retargeting

- Online dashboard for campaign tracking and analytics

For more advanced direct mail marketing campaigns, explore our direct mail marketing services division, Splash. It’s where traditional direct mail marketing meets digital marketing automation, elevating your outreach and marketing communications to new heights.

Learn more about our direct mail marketing division, Splash, to speak with a mortgage direct mail specialist.

Benefits of Direct Mail for Mortgage Companies

Discover why so many mortgage companies opt for direct mail as their primary marketing strategy:

- Omnichannel Campaigns: Our omnichannel direct mail campaigns combine traditional postcards with digital marketing re-targeting and social media display ads. Explore Amplify, our integrated marketing solution, to unlock the full potential of your campaigns.

- Brand Building: Direct mail plays a pivotal role in enhancing brand recognition. Be sure to keep your brand at the forefront of your customers’ minds so that, when they’re ready for your products and services, they turn to you.

- Transparency and Tracking: With direct marketing, transparency is paramount. We offer fully transparent tracking, allowing you to monitor campaign results at a granular level. Keep an eye on delivery and response rates for each mailer campaign.

- Precision Targeting: Target your audience with precision. To effectively engage your audience, utilize brochures, postcards, and flyers with personalized variable content, including graphics, messaging, and compelling CTA offers. This approach ensures your message resonates with your audience.

- Cost-Effective Solutions: Our targeted mailings utilize specific lists optimized for the best response rates, minimizing waste and maximizing your marketing budget.

No-Obligation Mortgage Mailing Solutions Consultation

Our advanced processes and technology empower us to deliver 100% data-to-document accuracy and integrity at each stage. We specialize in assisting mortgage loan companies in securely processing a variety of critical documents, effectively engaging clients, and achieving a strong return on investment. Let us assist your mortgage loan company in securely managing:

- Loan statements

- Marketing materials

- Tax-related documentation

- eStatements

- Monthly newsletters

- Multichannel direct mail campaigns

Feel free to contact us or give us a call at 714.436.3300 today for a commitment-free print and mail consultation. Schedule a product demonstration or request a review of your current mortgage document processing today!