Banks and Credit Unions, Credit Union Statement Outsourcing, Customer Experience and Engagement, How-to Guides, Marketing Strategies

Member Retention and Growth Strategies for Credit Unions

Don’t look now but credit union members and prospects are tuning out. And who can blame them? They’re busy, distracted and numb to the thousands of impersonal, irrelevant messages that bombard their senses daily. Credit union marketers can keep trying to connect the way they have been. Or, they can engage and move prospective and current members into action with growth strategies including cross-media marketing, omnichannel marketing and multichannel marketing.

This article will compare these different tactics to help distinguish which can best integrate marketing messages and strategies into your credit union’s member communications like member statements, bills and electronic statements.

What is Cross-Media Marketing?

Cross-media marketing integrates the same marketing message into a variety of media sources. This eliminates spending your entire marketing budget in one place, but instead, testing numerous communication tools. This will also provide a greater scope of data to analyze, test and implement in your next campaign. Examples of different media sources for credit union marketing are listed below.

Different Types of Marketing Media:

- Television commercials

- Radio ads

- Video marketing

- Email marketing

- Web ads

- Social media marketing

- Website and Mobile App Offers

- Direct mail postcards

- Print brochures

- eBooks

By using multiple media channels, credit unions can reach a wider target audience and increase the chances that a potential member will see their message. Another effective marketing strategy credit unions can leverage is omnichannel marketing.

What is Omnichannel Marketing?

Omnichannel marketing is similar to cross-media but goes beyond just using media for marketing and creates a seamless experience for customers across all channels. This can involve visiting a physical branch or interacting with the credit union through a phone call, website, or mobile application. By providing a consistent and cohesive experience, credit unions can build trust and brand consistency with current and potential members, increasing retention and attracting new members.

Different Types of Marketing Channels

- In-person experience at a branch location

- Voice calls

- Website and blog

- Email marketing

- Web ads

- Print ads

- Mobile apps

- SEO

- Social Media

Credit union marketers can get even more specific with targeting audiences by combining omnichannel and multichannel marketing.

What is Multichannel Marketing?

Multichannel marketing uses multiple marketing channels to engage with the same audience. However, unlike omnichannel, these channels are not necessarily integrated. Multichannel marketing creates multiple personalized touchpoints to engage a target audience and keeps your brand top of mind, but the content and style of these messages may be different from channel to channel. For example, credit unions can create fun and light video ads on TikTok for younger audiences and simultaneously target an older demographic, more serious in tone, with printed letters and direct mail postcards.

Examples of Omnichannel Marketing

- Social media ads + print ads

- Television commercials + in-person member events

- Offer letters + targeted Google ads

- Radio ads + mobile app marketing

- SMS offers + email marketing

Combining all three growth strategies to create personalized and seamless marketing campaigns that improve brand identity and member experience is a powerful tool for growth and retention. Credit unions can use a few additional strategies to stand out against their competition.

Growth and Member Retention Strategies for Credit Unions

1. Focus on the Member Experience

Build trust and loyalty among members by providing a personal experience and making it easy for them to manage their accounts and make transactions in-person or online.

Example: Credit union members often desire the ease of communication that large banks and conglomerates may not be able to offer them. The ability to speak with live staff over the phone, a simple submission process for questions and concerns online, or friendly and responsive employees at a physical branch location, go a long way.

2. Cross-Sell Products and Services

The cost of selling to existing credit union members is much cheaper than the cost of acquiring prospective members. Use data to understand member wants, needs and current financial situation.

Example: Credit union members often desire the ease of communication that large banks and conglomerates may not be able to offer them. The ability to speak with live staff over the phone, a simple submission process for questions and concerns online, or friendly and responsive employees at a physical branch location, go a long way.

3. Leverage Technology

Use technology like online account management, text notifications, electronic delivery, and mobile banking services to add convenience to the member experience.

Example: Provide flexibility and convenience by letting members choose how they want to be notified of new statements or payment due dates. Some members may prefer text notifications and paperless billing, while others prefer to have hard copies delivered and in-hand for record and archival purposes.

4. Engage with the Community

Participate in the local community. This can help to increase brand awareness and attract new members.

Example: Create events that benefit the community like hosting a blood drive or sponsoring a local sports team. This can build a new target audience and establish the credit union as a beneficial business to the local community.

5. Offer Exclusive Promotions and Discounts

Attract new members by offering a benefit that large financial institutions can’t provide.

Example: Some credit unions offer a $500.00 sign-up bonus for opening a checking account, low interest rates on auto loans or waived fees for a limited period.

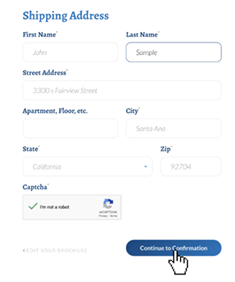

6. Personalize the Member Experience

Use data from member profiles, account history and past transactions to create personalized communications and offers.

Example: Data can show which members live in condos or homes. These members can be targeted with refinancing offers. Salutations in communications should never be generic, i.e “Dear Credit Union Member,” instead, using member names feels much more personal.

7. Provide Financial Education

Offer educational resources such as seminars, webinars, brochures and guides to help members understand the benefits and features of your products and services.

Example: Offer a webinar on consolidating and paying down debt. This is a great opportunity to promote a low-interest credit card with a balance transfer option.

8. Promote Brand Mission and Values

Spotlight the factors that make a credit union different from its competitors.

Example: Credit unions are typically not-for-profit cooperatives, meaning they are owed and controlled by their members. This differentiates them from commercial banks, so promoting this aspect can help attract members who are looking for a financial institution that aligns with their values.

9. Listen to Feedback

Regularly ask for feedback from members and use it to improve products, services and the overall member experience.

Example: Complainers are the best members because they help credit unions identify weak spots in service or convenience. Add a comment section to the website and a 1-800 number for members to voice concerns.

10. Utilize Transpromo Marketing

Combine transactional and promtional communications into one purposeful document. By integrating marketing messages into your statements, invoices and business documents, you maximize the available whitespace to reach existing, dedicated audience with targeted messages.

Example: Redesign documents with eye-catching color, graphics and targeted messaging to create inviting, easy-to-read printed or digital content. This builds member trust by speaking to their unique informational needs and interests.

Choosing and deploying the marketing strategies best fit for your credit union’s brand can be a daunting task. Partnering with an expert team with experienced specialists can make the process much easier.

For more questions about outsourcing for credit unions, read our FAQ.

How FSSI Helps Credit Unions Increase Growth and Member Retention

FSSI specializes in full-service statement printing and mailing solutions tailored to credit unions, whether they serve local, regional, or national member bases. Our seamless services cover essential documents like financial statements, monthly invoices, regulatory notices, secure MICR checks, and marketing mailers. With extensive experience across various industries, including banks, credit unions, auto finance, mortgage lenders, utility companies, healthcare, and more, we are well-versed in handling heavily regulated environments.

Our main objective is to help credit unions enhance their effectiveness, ROI, and member retention. We achieve this by combining our statement mailing services with industry best practices in layout, color usage, messaging, and more. Our Development and Creative Services teams collaborate with you to redesign statements, invoices, and other documents for maximum readability, impact, and value.

FSSI operates two production facilities equipped with high-speed printing and inserting equipment specifically designed for the financial industry. We can handle high-volume jobs with confidence, ensuring the security and confidentiality of all sensitive documents.

By outsourcing your transactional print and mail needs to FSSI, you entrust the production and delivery of statements, invoices, bills, marketing letters, and other critical customer documents to a trusted mail outsourcing provider. For more information about our custom credit union solutions, visit our credit union outsourcing FAQ page or call 714.436.3300 to speak with a document specialist today!