Banks and Credit Unions, Credit Union Statement Outsourcing, Customer Experience and Engagement, How-to Guides, Marketing Strategies

Member Retention and Growth Strategies for Credit Unions

Credit union members and prospects are tuning out. They’re busy, distracted, and numb to thousands of impersonal, irrelevant messages bombarding their senses daily. Credit union marketers can keep trying to connect the way they have been. Or they can engage and move prospective and current members into action with growth strategies, including cross-media marketing, omnichannel marketing, and multichannel marketing.

We will be comparing these different tactics to help distinguish which can best integrate marketing messages and strategies into your credit union’s transactional communications like member statements, bills, and electronic statements.

You’re already running campaigns. You know conversion rates matter and that scattered messaging burns budget. The question isn’t whether to diversify channels but how to structure that diversification for measurable lift. We will be discussing the use of omnichannel communication to help credit unions improve member growth and retention. We will also cover the ten best ways to implement these strategies into your member communications campaigns.

Cross-Media Execution

Cross-media distributes one core message across multiple channels to maximize reach and generate comparative performance data. You’re not just casting a wider net. You’re building a testing matrix.

Run the same membership incentive through direct mail, programmatic display, and organic social simultaneously. Track which channel drives account openings at the lowest CAC. Use attribution modeling to identify which touchpoint sequences convert best. Did they see the postcard first or the Facebook ad? The value isn’t in being everywhere. It’s in having channel-level performance data that informs your next allocation decision.

Channel examples worth testing:

- Programmatic video (YouTube, OTT platforms)

- Paid search and display retargeting

- Email nurture sequences

- Direct mail (dimensional mail performs 30% better than postcards for high-value offers)

- Organic and paid social

- Branch signage and statement inserts

- Member portal banners

Utilizing Ominchannel to Improve the Member Experience

Omnichannel solves a different problem: consistency across the member journey. This matters when members interact with you through multiple touchpoints before converting. A prospect sees your auto loan rate on Instagram, checks your website on mobile, then walks into a branch. If those three experiences feel disconnected (different rates, different messaging, different brand voice), you’ve introduced friction.

The hybrid distribution model data point (4% membership growth for institutions combining micro-branches, virtual banking, and physical hubs) reflects this principle. It’s not about having all three. It’s about making them feel like one institution.

Tactical applications:

- Pre-fill loan applications on mobile that members started on desktop

- Surface the same promotional offers in the branch that appear in email and on your mobile app

- Train branch staff on the current digital campaign messaging so conversations align

- Use CRM data to personalize web experiences based on member segments

- Maintain voice, tone, and visual identity across every channel

Multichannel Segmentation for Credit Unions

Multichannel lets you run different campaigns to different audiences simultaneously without requiring integration. This is useful when targeting segments with fundamentally different needs and media consumption patterns.

Gen Z checking account acquisition looks nothing like Boomer retirement planning. Run TikTok and Snapcats for the former with short-form video, meme culture references, and peer testimonials. Target the latter with financial planning content on Facebook, direct mail newsletters, and educational webinars. The messaging, tone, and creative executions can diverge completely because these audiences don’t overlap.

But here’s the trap: multichannel without strategy becomes fragmented brand identity. You need clear guardrails (core brand values, visual system consistency, service promise alignment) so you don’t confuse existing members who see multiple campaigns.

Combined Approach

The highest-performing credit unions layer all three:

- Cross-media for reach and performance comparison

- Omnichannel for journey consistency

- Multichannel for segment-specific targeting

Example: You’re launching a small business lending product. Run cross-media (same message, multiple channels) for awareness. Ensure omnichannel consistency so the experience from ad click to application submission feels cohesive. Use multichannel to target startups differently from established businesses. Different creative, different channels, different offers.

The differentiation isn’t in doing something competitors aren’t. It’s in execution discipline and measurement rigor.

Growth and Member Retention Strategies for Credit Unions

1. Focus on the Member Experience

Build trust and loyalty among members by providing a personal experience and making it easy for them to manage their accounts and make transactions in-person or online.

Example: Credit union members often desire the ease of communication that large banks and conglomerates may not be able to offer them. The ability to speak with live staff over the phone, a simple submission process for questions and concerns online, or friendly and responsive employees at a physical branch location go a long way.

2. Use Behavioral Data to Trigger Targeted Offers

The cost of selling to existing credit union members is much cheaper than the cost of acquiring prospective members. Use behavioral triggers and transaction patterns to identify the right moment for product recommendations.

Example: AI-powered systems can identify members whose auto loans are nearing payoff and automatically send targeted refinancing or new vehicle loan offers. Members showing contractor-like income patterns can receive business banking service promotions. Transaction data can reveal life events like home purchases, college graduations, or retirement planning phases, enabling timely outreach with relevant products.

3. Implement Churn Prevention Through Digital Insights

Use digital behavior insights to identify churn signals before members leave. Monitor inactive accounts, declining app usage, and reduced transaction frequency to deploy automated re-engagement campaigns.

Example: When a member stops logging into mobile banking for 30 days or reduces monthly transactions by 50%, trigger a personalized email sequence offering assistance, highlighting underutilized benefits, or providing exclusive retention offers. Strong onboarding campaigns can reduce new member churn from 40% by increasing early engagement through savings account invitations, credit card offers, and mobile banking setup guides.

4. Leverage AI and Marketing Automation

Use AI-powered tools and marketing automation to deliver personalized communications at scale without increasing headcount. Predictive analytics can identify which members are approaching major life events based on transaction patterns, demographic data, and behavioral signals.

Example: Automated email sequences for new member onboarding, “next best product” recommendations based on account history, and mortgage refinancing alerts when interest rates drop. Credit unions using marketing automation for personalized campaigns have generated millions in new deposits. AI systems can analyze member preferences and engagement patterns to ensure every interaction feels personalized and relevant.

5. Break Down Internal Sales Culture Barriers

Many credit union staff incorrectly interpret member-centricity as avoiding proactive product conversations, leaving members unaware of beneficial services. Train staff to understand that recommending relevant products is member service, not pushy sales.

Example: When a member mentions saving for a home during a branch visit, staff should feel empowered to discuss mortgage pre-approval options and first-time homebuyer programs. Frame product conversations as financial guidance rather than sales pitches.

6. Engage with the Community

Participate in the local community to increase brand awareness and attract new members.

Example: Create events that benefit the community like hosting a blood drive or sponsoring a local sports team. This builds a new target audience and establishes the credit union as a beneficial business to the local community.

7. Offer Exclusive Promotions and Discounts

Attract new members by offering a benefit that large financial institutions can’t provide.

Example: Some credit unions offer sign-up bonuses for opening a checking account, low interest rates on auto loans, or waived fees for a limited period. These incentives differentiate credit unions from traditional banks.

8. Personalize with 360-Degree Member Data

Use comprehensive data from member profiles, account history, and past transactions to create highly personalized communications and offers. Consider purchasing externally collected data that, when linked with internal data, provides an information foundation for targeted initiatives.

Example: Data can show which members live in condos or homes. These members can be targeted with refinancing offers. Salutations in communications should never be generic like “Dear Credit Union Member.” Using member names and referencing their specific account relationships feels much more personal.

9. Provide Financial Education

Offer educational resources such as seminars, webinars, brochures, and guides to help members understand the benefits and features of your products and services.

Example: Offer a webinar on consolidating and paying down debt. This is a great opportunity to promote a low-interest credit card with a balance transfer option. Educational content positions your credit union as a trusted financial advisor, not just a transaction processor.

10. Listen to Feedback and Use AI to Track Interactions

Regularly ask for feedback from members and use it to improve products, services, and the overall member experience. Implement centralized communication records systems that use AI-driven tools to avoid repetitive conversations and reduce member annoyance.

Example: Complainers are your best members because they help credit unions identify weak spots in service or convenience. Add a comment section to the website and a dedicated phone line for members to voice concerns. Use AI to track previous interactions so staff can reference past issues without making members repeat themselves.

Choosing and deploying the marketing strategies best fit for your credit union’s brand can be a daunting task. Partnering with an expert team with experienced specialists can make the process much easier.

For more questions about outsourcing for credit unions, read our FAQ.

The Power of Transpromo Marketing for Credit Unions

Combine transactional and promotional communications into one purposeful document. By integrating marketing messages into your statements, invoices, and business documents, you maximize the available whitespace to reach an existing, dedicated audience with targeted messages. This approach capitalizes on high visibility because transactional documents like bills and statements are consistently opened and reviewed.

Why Transpromo Works

- Bills and statements have near 100% open rates, far exceeding email marketing

- No separate distribution costs since you’re leveraging existing communications

- Enhanced personalization using customer data from transaction history and demographics

- Increases perceived value of routine communications by making them more relevant

Example: Redesign statements with eye-catching color, graphics, and targeted messaging to create inviting, easy-to-read printed or digital content. A member with a high checking account balance might see a message about CD rates or investment services directly on their monthly statement. Members with mortgage payments could see home equity line of credit offers. This builds member trust by speaking to their unique informational needs and interests based on actual financial behavior.

How FSSI Helps Credit Unions Increase Growth and Member Retention

Whether you serve a local, regional, or national member base, FSSI’s full-service statement printing and mailing services can tailor a statement processing solution to fit the needs of your credit union. We make it easy to send business-critical documents like financial statements, monthly invoices, regulatory notices, secure checks with MICR, and marketing mailers. We’ve partnered with banks, credit unions, auto finance, mortgage lenders, utility companies, healthcare, and other heavily regulated industries.

Our main goals are to help your credit union increase effectiveness and ROI while improving member retention. By combining our statement mailing services with industry best practices for layout, color usage, on-page messaging and more, our development and creative services teams help you redesign statements, invoices, and other documents for maximum readability, impact, and value. From full-color variable data printing to commercial document printers, FSSI can help you produce all types of business-critical documents.

We have four production facilities that provide high-speed printing and inserting equipment designed for the financial industry. We can accommodate high-volume jobs, with the technology and security guarantees in place to compose, print, and insert all your sensitive, confidential documents.

Read our Credit Union Outsourcing Guide to learn more about our products and solutions.

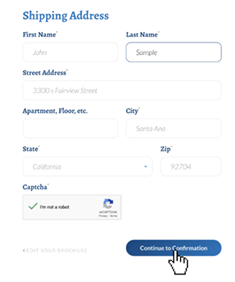

When you outsource transactional print and mail, you hand off the production and delivery of statements, invoices, bills, direct mail marketing letters, and other business-critical customer documents to a mail outsourcing provider like FSSI. Visit our credit union outsourcing page for more information about our custom credit union solutions or call 714.436.3300 to speak with a document specialist today!