Billing, Collections and Payments, Direct Mail Marketing, Outsourcing, Print and Mail Services, Regulatory Compliance

Improve Auto Finance Communications with Print and Mail Outsourcing

The auto finance industry is experiencing rapid growth, presenting lenders with new opportunities and challenges. As companies focus on core business activities like acquisitions, collections, and compliance, managing customer communications can become a costly distraction. Outsourcing print and mail services for customer documents to a specialized provider like FSSI can eliminate these operational challenges and streamline processes.

FSSI offers comprehensive, compliant auto finance print mail outsourcing for customer communications, leveraging nearly 45 years of experience in print and mail solutions for the auto finance industry. Our turnkey offering provides an integrated approach that encompasses:

- Printing loan documents

- Direct mail campaigns

- Regulatory communications

- Marketing mailings

- Monthly statements

- Invoice printing and mailing

By partnering with FSSI, auto finance companies can ensure efficient, professional, and timely delivery of critical customer documents while freeing up resources to focus on core business functions. Our expertise in the auto finance sector allows us to provide customized solutions that meet the unique needs of lenders, helping them maintain strong customer relationships and comply with industry regulations.

Auto Finance Customer Communications Trends

Managing and producing monthly statements can be costly, time-consuming and divert your office staff from strategic business management. With auto finance companies regaining the majority of total vehicle financing in 2023, there is an even greater need to regain time and control. Here’s why:

Industry Growth

The number of car loans for new, leased and used vehicles is on the rise, with an increased demand for electric vehicles and refinancing opportunities contributing to industry growth.

- 13.7 million consumers hold a traditional installment loan

- 6.5 million consumers are in the prime or better risk tier

- 2.3 million new auto loans each month

What Are Today’s Borrowers Expecting from Auto Finance Lenders

Digital and Self-Service Experiences

There is a growing consumer preference for digital billing, payment, and account management experiences in auto finance:

- 79% of consumers expect electronic access to view their loan/lease details online.

- 72% want to view their payment history online.

- 70% prefer receiving electronic monthly statements over paper.

- 65% want to receive digital payment alerts/reminders.

- 49% of prospective buyers intend to apply for an auto loan digitally through the lender’s website or mobile app.

Providing self-service digital capabilities like online account access, paperless statements, payment scheduling/AutoPay, and multiple payment options (debit, ACH, digital wallets) is becoming essential to meet modern consumer expectations.

Personalized and Omnichannel Communications

Auto lenders are leveraging customer communications management (CCM) platforms to deliver personalized messages through the customer’s preferred channels – mail, email, text, mobile wallets. Omnichannel communications enable lenders to guide customers toward digital experiences while still supporting traditional paper for those who prefer it.

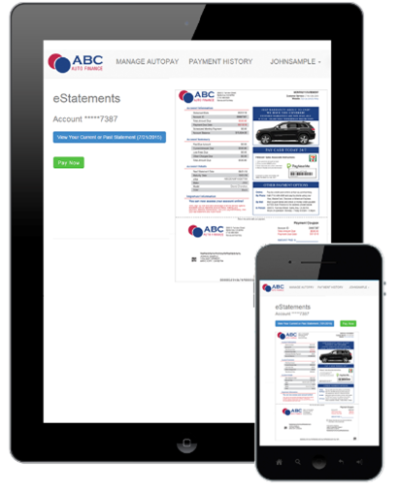

Clear and Intuitive Billing Statements

Simplifying statement design by prominently displaying payment amounts, due dates, and payment links/options can encourage prompt payments. Using bold colors, easy-to-understand language, and promoting paperless/AutoPay sign-ups also improves the customer experience.

Connected Car Data Integration

As connected car technology advances, auto finance companies can integrate real-time vehicle data and usage information to enable new billing models like usage-based leasing, where customers pay based on miles driven or features used. By embracing digital transformation, self-service tools, personalized communications, and emerging technologies, auto lenders are aiming to deliver a modern, convenient experience that drives customer satisfaction and loyalty.

Secure Auto Finance Document Delivery

We prioritize the security of your sensitive financial data. Our state-of-the-art measures ensure the safe handling of all your auto finance communications. From secure printing and mailing of auto loan statements to managing regulatory compliance letters, we’ve got you covered. Our services extend to confidential vehicle finance customer communications and automotive lending compliance reporting, providing you with peace of mind and allowing you to focus on your core business operations.

Comprehensive Automotive Finance Document Management

Our turnkey solution covers a wide range of auto finance communications:

- Car loan welcome package printing

- Vehicle loan statement processing and mailing

- Automotive finance eStatement services

- Car finance document archival

- Auto loan payment processing integration

Advantages of Outsourced Auto Finance Invoice Printing and Mailing

Operational Efficiency

Auto finance companies have an opportunity to reduce operational costs and improve productivity while meeting their customers’ billing and communication needs.

Compliant Communications

Partnering with a document outsourcing provider ensures that critical communications are compliant with the latest regulations and guidelines impacting lending operations.

Customer Satisfaction

Providing excellent customer service extends beyond the initial auto purchase to include every interaction, including the timely delivery of monthly statements and notices.

The Ultimate Customer Communications Toolbox

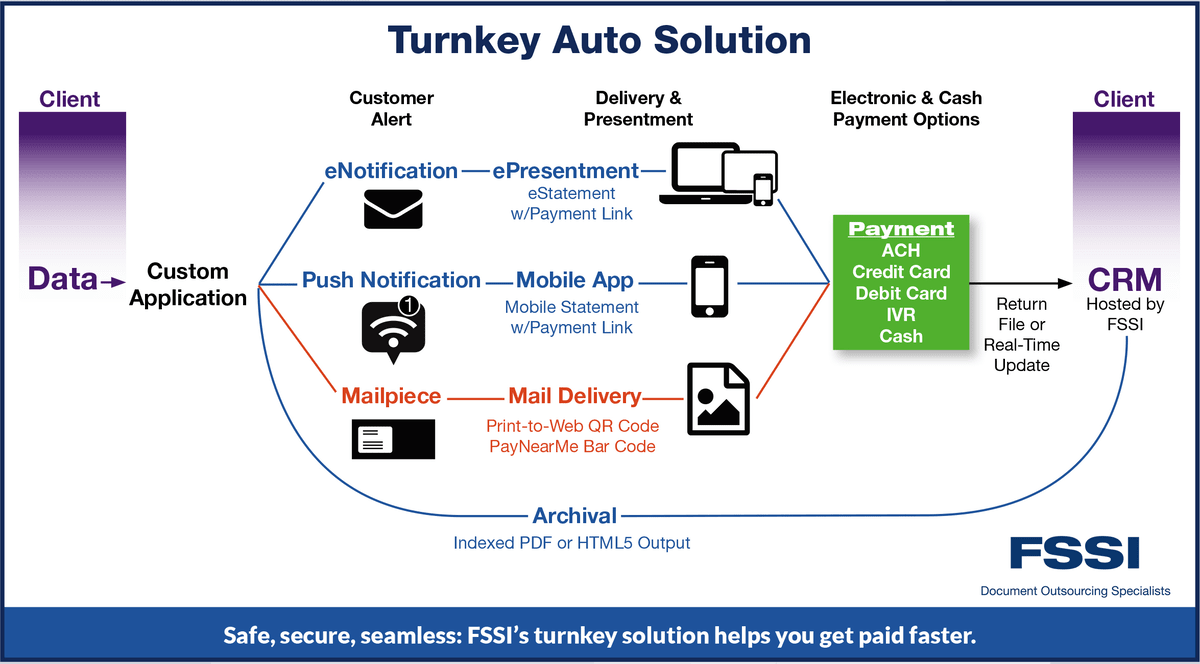

FSSI’s Comprehensive solution is designed with the print-mail and electronic delivery needs of the auto finance industry in mind and helps to get you to market fast. We offer an all-in-one integrated print and mail solution with everything you need to quickly gain a competitive advantage.

FSSI’s Auto Finance Communications Solutions Include:

- Custom Statement Design

- Payment Drivers

- Electronic Presentment and Delivery

- Payment Processing

- Document Archival

- Online Job Tracking

- Compliance Reporting

- Online Print-Mail Letter Fulfillment

Built on years of auto finance experience, the turnkey solution gives you greater control over the look, content and production of all printed and electronic documents. It helps you satisfy customers’ multichannel delivery preferences and is compatible with major data platforms.

Compatible with the Following Data Platforms:

- SHAW Systems

- MegaSys

- CMSI

- DEFI

- And others!

This flexibility helps ensure a more satisfying customer experience, regardless of your data provider.

How Can Electronic Presentment Improve Customer Satisfaction in Auto Finance

Electronic presentment and payment (EBPP) solutions can significantly improve customer satisfaction in the auto finance industry by providing borrowers with convenient, flexible, and self-service options for managing their loan accounts and payments.

Components of FSSI’s electronic document delivery include:

- Email Notifications—When eDocuments are ready for viewing, the application automatically alerts enrolled customers through attractive, templated emails you can customize with your logo and branding.

- Payment Processing—We can act as your eBill and invoice repository, securely serving up PDF and HTML documents that link to your preferred payment module, or we can provide a complete EBPP solution through a world-class bill payment partner, such as PayNearMe.

- Document Archival and CRM—Enjoy unlimited archival capacity and online CRM hosted by FSSI, and custom-indexed files for use on your internal reporting system.

Here are some key ways EBPP enhances the customer experience:

Multichannel Delivery Preferences

EBPP allows customers to receive statements and make payments through their preferred channels like email, mobile apps, or online portals, catering to the growing demand for digital experiences. This satisfies 70% of consumers who want electronic monthly statements and the 79% who expect electronic access to loan details.

Self-Service Account Management

With EBPP, borrowers can view real-time loan information, payment history, and make payments anytime, anywhere through digital channels. This self-service convenience improves satisfaction by giving customers control over managing their accounts on their terms.

Payment Flexibility

EBPP enables auto finance companies to offer flexible payment options like one-time, recurring AutoPay, payment plans, and accept multiple payment types (ACH, debit/credit cards, digital wallets). This flexibility reduces friction and accommodates different customer preferences for making loan payments.

Payment Reminders

Email or text payment reminders through EBPP help customers avoid missed payments and late fees, improving their financial well-being and satisfaction with the lender. Around 65% of consumers want digital payment alerts.

Faster Issue Resolution

With online account access through EBPP, customers can quickly get information to resolve inquiries themselves instead of waiting for customer service. This self-service capability enhances the customer experience. By providing digital billing, payment, and account management options aligned with modern consumer expectations, EBPP solutions enable auto lenders to deliver a superior customer experience that drives satisfaction, loyalty, and retention.

Online Job Tracking and Compliance Reporting

Access a wealth of live production intelligence right at your fingertips. View top-line data at a glance or drill down deeper for a more comprehensive analysis. You may also approve files, view job status or monitor inventory and postage in real-time, anytime.

Online Print-Mail Letter Fulfillment

Approve and revise letter and notice content as often as you want, without incurring extra development costs. Use in conjunction with your statement production to ensure compliant processing and delivery of standard and mandated financial documents, such as:

- Welcome and Annual Privacy Letters

- AA letters–TD and Conditional

- Collection and NSF letters

- RTC and NOI notices

- Cancellation, past due and deficiency notice

- Repo and reinstatement letters

Comprehensive Automotive Finance Document Management

Our turnkey solution covers a wide range of auto finance communications:

- Car loan welcome package printing

- Vehicle loan statement processing and mailing

- Automotive finance eStatement services

- Car finance document archival

- Auto loan payment processing integration

Enhance Your Automotive Lending Communications

Leverage our expertise to improve your customer engagement:

- Custom auto finance statement design with payment drivers

- Vehicle finance privacy notice mailing

- Car loan regulatory correspondence management

- Automotive finance direct mail marketing campaign

- Custom document design with payment drives like QR codes

Add Horsepower to Communications with These Options:

When business strategies call for an added measure of marketing or compliance-tracking, take advantage of FSSI’s powerful integrated service options:

- Document message management: A self-managed portal supports data-driven personalization; an intuitive message campaign editor inserts targeted marketing or educational messages using fully formatted color text and graphics.

- Piece-level reporting: Displays the real-time status of each piece in the mailstream, from file receipt at FSSI through delivery to the USPS; provides 100% data-to-mail integrity with online, real-time reporting.

- IMb™ (intelligent mail barcode): Includes the latest generation of USPS® mailpiece barcode technology, which can help you track incoming remittance payments, monitor cash flow, and save money on collection calls.

Accelerate Auto Loan Growth with Outsourced Direct Mail Marketing

Capture more auto financing opportunities by partnering with FSSI for your outsourced auto finance direct mail and marketing mail needs. Our data-driven direct marketing solutions are tailored to help lenders effectively promote vehicle financing offers, lease programs, and exclusive deals directly to prospects and existing customers.

Outsourced Auto Finance Marketing Mail Offerings

- High-impact direct mail designs like engaging postcards and persuasive marketing letters

- Advanced variable data printing for personalized messaging

- Access to targeted consumer mailing lists for precise audience segmentation

- Integrated digital marketing automation and online retargeting campaigns

- User-friendly online dashboard for comprehensive campaign tracking

Our turnkey outsourced auto finance direct mail services provide a seamless 100% automated process from creative concept through printed mailpiece production and targeted distribution. Robust analytics give you full visibility into campaign performance.

Extend Your Marketing Reach

Complement your outsourced auto finance marketing mail initiatives with powerful digital channels through our marketing services division, Splash. Their expertise ensures your direct mail campaigns are strategically integrated with email, online advertising, social media and more for maximum impact. Don’t let opportunities slip away – accelerate auto loan acquisition and portfolio growth with FSSI’s outsourced auto finance direct mail solutions. Explore customized multichannel marketing programs by contacting us today.

Why Partner with FSSI?

If your current print-mail provider is stuck in second gear and unable to keep up with your production or compliance-reporting needs, it might be time to trade up. FSSI is a trusted provider for consumer lenders of all types and sizes with the specialized tools, technologies and knowledge to help your lending company.

Benefits of Outsourcing:

- Reduce the time and cost of customer onboarding, servicing and collections

- Manage compliance risk and create a defensible audit trail

- Enjoy the convenience, savings and security of a bundled, highly scalable solution

- Leverage the financial returns of document outsourcing

Don’t Miss Your Free Print-Mail and Electronic Document Services Consultation

The auto finance industry is more competitive than ever. Give your company an advantage today with customized print and mail services from FSSI. Call us at 714.436.3300 for a no-obligation consultation.

Sources:

https://www.nordistechnologies.com/blog/auto-finance-companies-aiming-to-improve-customer-experience-should-double-down-on-digital/

https://earnix.com/blog/digital-auto-finance-trends-opportunities-for-lenders

https://tweakyourbiz.com/posts/finance-news-websites