Print and Mail Services for the Mortgage Industry

Mortgage lenders face mounting pressure to streamline operations, reduce costs, and ensure compliance in a highly regulated industry. One of the most effective ways to achieve this is through print and mail outsourcing for the mortgage industry. By partnering with a trusted provider, mortgage companies can simplify the printing, mailing, and delivery of time-sensitive borrower communications while maintaining data security and regulatory accuracy

Why Mortgage Lenders Outsource Print and Mail?

Outsourcing print and mail services allows mortgage companies to focus on lending operations while ensuring critical borrower communications are handled with precision. Whether you’re mailing borrower notices, mortgage statements, escrow letters, or regulatory disclosures, an outsourcing partner can provide:

- Scalability during peak lending and refinancing seasons

- Lower operational costs through automated workflows

- Faster turnaround times for borrower notices and correspondence

- Enhanced document tracking and delivery reporting

- Compliance with federal and state mortgage communication regulations

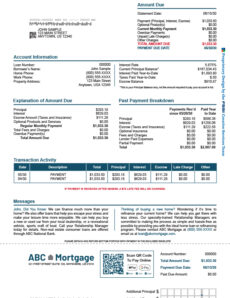

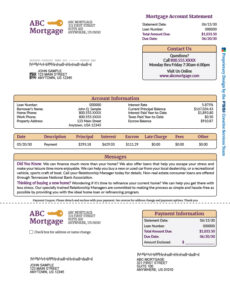

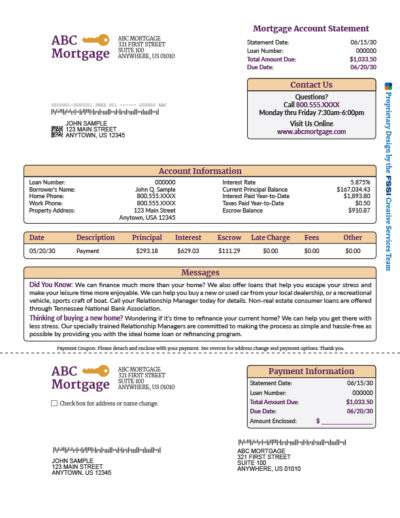

Mortgage Document Sample PDFs

Take a deeper look at our statement printing and mail outsourcing services.

Common Mortgage Documents Managed Through Print and Mail Outsourcing

A specialized mortgage print and mail outsourcing provider can manage a wide range of borrower-facing documents, including:

- Welcome packets, declination and credit collection letters

- Past due, privacy and compliance notices

- Direct mail marketing, postcards and cross-selling materials

- Loan modifications and refinancing proposals

- Escrow analyses and annual escrow disclosures

- Notice of the right to rescind

- State and local government-mandated documents

- Direct mail postcards and mailers

- HELOC documentation

- Credit and loan statements and disclosure notices

- DDA statements

Compliance and Data Security in Document Outsourcing

In the mortgage industry, compliance and data protection are non-negotiable. A qualified print and mail outsourcing partner ensures:

- Data encryption and secure file transfers

- Document integrity with quality control at every step

- USPS-certified addressing and Intelligent Mail barcoding

- Integration with compliance monitoring and audit trails

- Adherence to changing regulatory guidelines

- Building security

- Employee training

Our core values include a strong focus on data security, privacy, business continuity, and disaster recovery. FSSI undergoes annual SOC 2 audits and maintains HIPAA compliance in all of our facilities

About FSSI

With over 45 years of experience, FSSI is a leader in print and mail outsourcing for the mortgage industry, ensuring secure and compliant borrower communications. We manage the production and delivery of statements, regulatory notices, and personalized marketing materials crucial for mortgage lenders and servicers.

Our secure operations (SSAE-18 Type II audited), advanced technology and focus on accuracy help mortgage companies engage borrowers throughout the loan lifecycle.

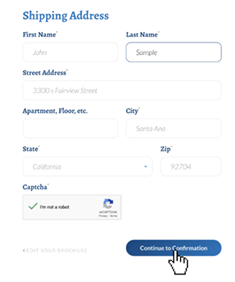

We serve mortgage lenders and servicers from four locations nationwide. FSSI’s corporate headquarters are in Santa Ana, California, with strategically located print and mail facilities in Coppell, Texas; Orlando, Florida; and Lincoln, Rhode Island. This multi-site infrastructure ensures uninterrupted processing of loan documents, escrow statements, and time-sensitive documents while maintaining secure data handling and operational redundancy across all facilities.

The Benefits of Partnering with a Mortgage-Focused Print and Mail Provider

- Faster borrower communications: Cut down delivery times during high-volume loan cycles

- Cost efficiency: Eliminate the capital expense of in-house printing, mailing equipment, and staff

- Regulatory alignment: Ensure that all mortgage statements, disclosures, and notifications comply with current federal and state guidelines

- Omnichannel integration: Many providers now offer digital presentment options alongside print, supporting e-delivery compliance requirements

- Scalability: Handle monthly statement volumes and accommodate unexpected demand surges without disruption

Digital and Omnichannel Communication for Mortgage Firms

While print communication remains critical, today’s borrowers expect faster, digital-first solutions. Outsourcing providers often blend print and electronic delivery (eStatements, email, text notifications) into a cohesive borrower communication strategy. This ensures mortgage companies can:

- Meet borrowers where they are with physical and digital communications

- Reduce mailing costs by encouraging digital adoption

- Improve borrower satisfaction and loyalty with seamless communication options

- Real-time online letter template management

- Online and mobile payment processing integrations

Scalable Lender Document Management and Mailing Solutions

Effective communication through transactional documents like loan statements and notices is paramount. FSSI’s mortgage printing solutions unlock the full potential of these touchpoints, enabling you to forge deeper customer connections and drive engagement.

We specialize in streamlining mortgage document processes by leveraging cutting-edge automation. Our seamless outsourcing services ensure secure document printing and timely mortgage document delivery of critical communications, including home loan disclosures.

Read more about the security and privacy infrastructure at FSSI, and see why our clients have trusted us to process and distribute secure financial documents for nearly 45 years.

Mortgage Document Redesign Services

As part of a complete print and mail outsourcing solution for the mortgage industry, document design plays a critical role in borrower communications. Even the most compliant and timely mortgage statements lose effectiveness if borrowers cannot easily understand them. That is why FSSI provides mortgage document redesign services through our in-house design team. We help lenders transform required notices, statements, and disclosures into clear, professional communications that improve borrower engagement and reduce the risk of confusion or missed payments.

Well-designed mortgage documents do more than convey information; they shape the borrower’s experience, influence payment behaviors, and build trust in your brand. Outdated layouts or poorly structured statements can confuse borrowers, increase customer service calls, and even contribute to late payments. Our approach ensures your mortgage documents are both compliance-driven and designed to support your business goals.

Our in-house designers combine compliance expertise with proven design strategies to:

- Guide Payment Remittance: Create clear, easy-to-read statements that improve borrower comprehension and reduce delinquency. By using bold visual cues, clean layouts, and intuitive icons, we highlight payment amounts, due dates, and interest rates. This makes it simple for borrowers to know exactly what action to take, resulting in fewer missed payments and more consistent cash flow.

- Enhance the Borrower Experience: Professionally designed documents instill confidence and build stronger borrower relationships. Our design team ensures your statements, notices, and disclosures are not only compliant but also visually engaging and aligned with your brand.

- Support Cross-Selling and Marketing Initiatives: With our document message management tools, you can add personalized messages, graphics, and promotions directly into mandatory borrower communications. This approach, often referred to as transpromotional marketing, turns required mailings such as mortgage statements into powerful, cost-effective touchpoints for introducing other lending products or providing financial education.

By leveraging our in-house mortgage document design expertise, your company can make every borrower communication a strategic asset that ensures compliance, improves clarity, and strengthens customer loyalty.

Mortgage Direct Mail Services for Lenders

With over 45 years of expertise managing secure financial communications, FSSI provides mortgage direct mail services that help lenders connect with borrowers and prospects in meaningful, measurable ways.

From postcards to customized letters, we create and deliver highly targeted mortgage marketing campaigns that build trust, drive response, and keep your brand top of mind. Backed by industry-leading data security and compliance, every campaign meets the strict requirements of the lending and mortgage servicing industry.

Why Direct Mail Marketing Works for Mortgage Lenders

Direct mail for mortgage companies remains one of the most effective channels for borrower engagement, especially in such a digital-focused world. Unlike email, which can easily get deleted or filtered into spam, direct mail stands out. It is tangible, personalized, and can be tailored to support everything from loan promotions to regulatory borrower communications. By extending your sales and marketing team’s reach, mortgage direct mail campaigns:

- Strengthen brand recognition with consistent, professional communication

- Generate quality leads for refinance, purchase, and HELOC products

- Reinforce customer relationships through personalized messages

- Increase borrower response rates compared to digital-only campaigns

Comprehensive Mortgage Direct Mail Services

FSSI’s end-to-end mortgage direct mail outsourcing solutions allow lenders to run large-scale, compliant campaigns efficiently and cost-effectively. Popular services include:

- Postcards and Letters: Reach prospects with visually engaging loan offers and timely borrower messages

- Variable Data Printing: Personalize each mail piece with borrower-specific data, interest rates, or targeted offers

- Targeted Mailing Lists: Reach precise borrower segments with data-driven targeting for high-value leads

- Mortgage Servicing Communications: Mail borrower notices, disclosures, and servicing updates alongside marketing campaigns

- Integrated Digital Retargeting: Reinforce campaigns with email, online ads, and social media touchpoints

- Dashboard Campaign Tracking: Monitor performance and ROI in real time with secure, online analytics reporting

For more advanced direct mail marketing campaigns, explore our direct mail marketing services division, Splash. It’s where traditional direct mail marketing meets digital marketing automation, elevating your outreach and marketing communications to new heights.

Learn more about our direct mail marketing division, Splash, to speak with a mortgage direct mail specialist.

No-Obligation Mortgage Print and Mail Consultation

With today’s compliance requirements and borrower expectations, secure and reliable mortgage mailing outsourcing has never been more important. FSSI’s advanced processes and technology ensure 100% data-to-document accuracy at every stage, giving mortgage companies confidence that their most critical communications are delivered on time, every time.

We specialize in helping mortgage lenders securely manage and distribute a wide range of borrower communications, including:

- Loan statements and payment notices

- Mortgage marketing materials and borrower outreach campaigns

- Tax-related documentation and escrow reporting

- Digital and print eStatements

- Monthly newsletters and borrower education pieces

- Multichannel and direct mail campaigns for mortgage products

By outsourcing your print and mail processing to a trusted industry partner, your mortgage company can reduce operational costs, improve compliance, strengthen borrower trust, and free up valuable internal resources.

Ready to see the difference? Contact us online or call 714.436.3300 today to schedule a no-obligation consultation. Request a product demonstration or a review of your current mortgage document processes and discover how outsourcing can transform your borrower communications.