Print and Mail Services for Auto Finance

FSSI has 45 years of experience in print and mail outsourcing for auto finance. Let us help you craft customer communications that resonate with your clients and regulatory authorities. Our comprehensive print and mail solutions, including statement processing and critical mail distribution, are tailored for auto finance companies.

This offers a simplified approach to document processing and mailing of business-critical documents. Mitigate risks, enhance regulatory compliance, and drive collection efforts effectively through our secure printing and mailing services.

Customers demand billing statements that are clear, concise, and user-friendly. Simultaneously, legislators aim to ensure adherence to the latest consumer protection regulations. With our secure printing and mailing services, electronic delivery options like eStatements, and integrated payment processing, you can meet the requirements and expectations of both groups. Leveraging document process outsourcing for your auto finance print and mail needs can improve operational efficiency, ensure accuracy, and strengthen your overall customer communication management strategy.

Print and Mail Services Include:

- Statement processing and mailing

- eStatement processing, eDelivery, online banking portals

- Direct mail marketing and variable data printing

- Letter printing and mailing

- In-house graphic design and development team

- 24/7 online client-facing job tracking and mailpiece reporting

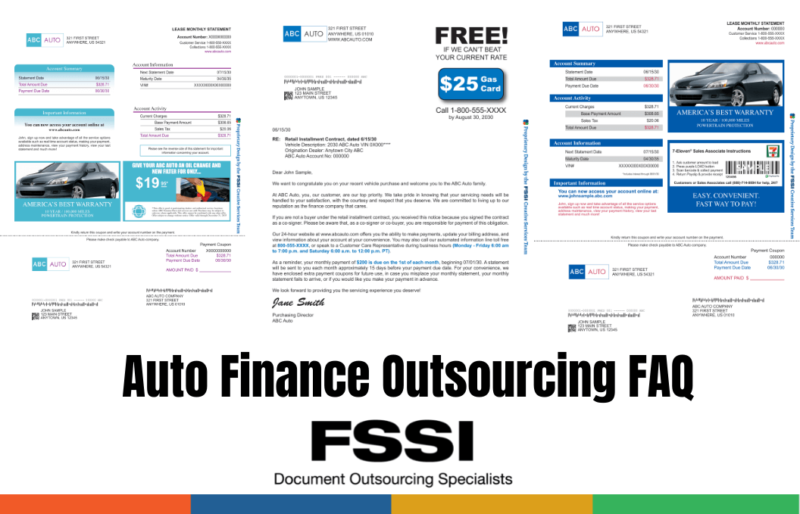

Auto Loan Statement Statement Samples

Learn more about our turnkey print and mail solutions for auto finance.

Types of Financial Documents: Printed, eStatements, Email, SMS

We specialize in producing a wide array of crucial documents tailored to the specific needs of auto finance companies. From clear and concise loan bills and statements to comprehensive welcome packages, annual privacy letters, and AA letters (TD and Conditional), we cover every facet of your communication requirements.

Our expertise extends to crafting effective collection and NSF letters, RTC and NOI notices, as well as cancellation and past-due notices. Navigate the complexities of deficiency balances, repo and reinstatement letters with ease, and trust us for one-time drafts or mailers that make a lasting impact.

- Loan bills and statements

- Welcome packages

- Annual privacy letters

- AA letters – TD and conditional

- Collection and NSF letters

- RTC and NOI notices

- Cancellation and past-due notices

- Deficiency balances

- Repo and reinstatement letters

- One-time drafts or mailers

- Adverse action notices

- Certified mail

- Direct mail postcards and marketing letters

Trusted Print and Mail Solutions for the Auto Finance Industry

At FSSI, we leverage our extensive auto finance industry expertise to provide comprehensive print and mail solutions tailored to the unique needs of auto lending companies like Exeter. Our services encompass the entire lifecycle of time-sensitive billing statements and notices, from design and formatting to data processing, production, and delivery.

We understand the critical importance of timely and accurate billing communications in the auto finance industry. See how our solutions empowered Exeter with greater control over the look, content, and production of printed and electronic documents, including custom statement design with payment drivers, electronic presentment and delivery, payment processing, document archival, and online job tracking.

Your Full-Service Auto Finance Mail Outsourcing Solution

Outsourcing the production of printed and electronic customer communications to FSSI can help you stay focused on building your business. We have over 45 years of financial printing experience, offering a bundled, highly scalable solution designed for both fast-growing and well-established lenders.

When business strategies call for an added measure of marketing or compliance tracking, take advantage of FSSI’s powerful integrated service options:

- Document Message Management: A self-managed portal that supports data-driven personalization; intuitive message campaign editor inserts targeted marketing or educational messages using fully formatted color text and graphics

- Piece Level Reporting: Displays the real-time status of each piece in the mailstream, from file receipt at FSSI through delivery to the USPS; provides 100% data-to-mail integrity with online, real-time reporting

- USPS Optimization: IMb™ (intelligent mail barcode): The USPS® mailpiece barcode technology can help you track incoming remittance payments, monitor cash flow, and save money on collection calls. USPS First-Class Mail, Priority Mail and Certified Mail delivery. FedEx and UPS delivery options

- Wide Variety of Print Outputs: Full-color, black and white, Inkjet, Screen, Xerox, Canon, MICR and variable data printing

- Online Letter Template Management Tools: Approve and revise letter and notice content as often as you want, without incurring extra development costs. Use in conjunction with your statement production to ensure compliant processing and delivery of standard and mandated financial documents

- Online Job Tracking and Compliance Reporting: Access a wealth of live production intelligence right at your fingertips. View top-line data at a glance or drill down deeper for a more comprehensive analysis. You may also approve files, view job status or monitor inventory and postage, in real-time, anytime

- Multichannel Direct Mail Marketing: Services include an in-house design team as well as experienced developers

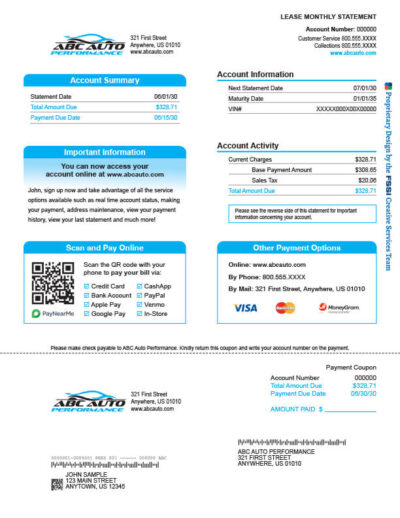

- Custom Document Design with Payment Drivers: Strategic document composition and design make it simple for borrowers to remit payments with an easy-to-navigate layout and highlighted payment features, such as PayNearMe’s cash payment barcode, QR codes and multiple payment coupons

eStatement Processing and Payment Processing and Presentment

Satisfy customers’ multichannel preferences with multiple electronic bill presentment and payment options. Your email and text alerts are sent via FSSI’s convenient eNotify platform, which delivers critical communications on time, every time, diverting spam filters and abiding by security protocols. Components of FSSI’s eStatement delivery solution include:

- Text and Email Notifications: When eDocuments are ready for viewing or a payment is due, the application automatically alerts enrolled customers via attractive, templated emails you can customize with your logo and branding or text messages that are sent utilizing an integrated text messaging service

- Payment Processing: We can act as your eBill and invoice repository, securely serving PDF and HTML documents that link to your favorite payment module, or we can provide a complete EBPP solution through FSSI’s preferred payment partner, PayNearMe, a leading payment processor, as well as through your payment provider

- Document Archival and CRM: Enjoy unlimited archival capacity and online CRM hosted by FSSI, and custom-indexed files for use on your internal reporting system

Remain Compliant with Changing Government Regulations

Staying compliant with ever-changing regulations is challenging. Government bodies like the FDIC and the CFPB require constant vigilance. At FSSI, we prioritize updating our security measures and data privacy practices to safeguard sensitive information.

Our core values include a strong focus on data security, privacy, business continuity, and disaster recovery. FSSI undergoes annual SOC 2 audits and maintains HIPAA compliance in our facilities, with rigorous security practices that exceed industry standards, including:

- Building security

- User/server-level security

- Secure data standards

- Secure data archival options

- Document security

- Employee training

Learn more about FSSI data security and privacy infrastructure.

Targeted Direct Mail for Auto Finance and Car Dealerships

Improve your auto finance marketing with our specialized direct mail services. Our campaigns are designed to attract potential customers and showcase new offerings to your current borrowers.

Our direct mailers effectively communicate vehicle financing options, including lease terms, exclusive deals, and finance programs, reaching individuals actively seeking special offers for their next car purchase.

Auto Finance Direct Mail Services:

- Attention-grabbing postcards: Create visual impact with designs that highlight your best auto finance deals.

- Persuasive marketing letters: Develop personalized messages that connect with car buyers and emphasize your competitive financing options.

- Tailored printing: Use variable data printing to customize each mailer to the recipient’s specific interests.

- Focused mailing lists: Reach potential car buyers and those considering auto refinancing with accurately segmented lists.

- Integrated digital marketing: Pair direct mail with online retargeting to reinforce your auto finance message across multiple channels.

- Live performance tracking: Monitor your campaign’s success with our user-friendly online dashboard.

Our data-driven, comprehensive direct marketing solution works in tandem with powerful digital strategies for optimal results. Benefit from a fully automated process with carefully selected promotional activities to expand your reach in the auto finance market. Our online dashboard offers complete attribution, providing clear visibility and tracking of your campaign’s performance.

Learn how our advanced direct mail and auto finance marketing campaigns can bring more qualified leads to your dealership or finance company. Our targeted approach ensures your message reaches consumers at the right time in their car-buying process, maximizing your marketing ROI and increasing loan applications.

Explore the possibilities of our advanced direct mail and auto finance marketing campaigns by visiting our dedicated marketing services division, Splash.

Speak with an Auto Finance Industry Specialist

Our cutting-edge processes and technology empower us to ensure 100% data-to-document integrity and precision at every stage. Whether you’re reaching out to specific clients or enhancing your overall communication strategy, we can assist your auto finance company produce impactful documents that drive action and deliver a strong return on investment. Let us support your auto finance business in securely processing:

- Auto finance statements

- Strategic marketing communications

- Tax-related documents

- Electronic statements (eStatements)

- Monthly newsletters

- Multichannel direct mail campaigns and more!

The auto finance industry is more competitive than ever. Give your company an advantage today with a full-service print and mail solution from FSSI designed for auto lenders. Contact us online or call us at 714.436.3300 for a no-obligation consultation.